Janus

Advocatus Diaboli

- Sep 9, 2007

- 23,424

- 57,316

- AFL Club

- Port Adelaide

- Other Teams

- Dallas Cowboys, Chicago Bulls

Pulled out of everything on Tuesday morning - missed the initial Monday sell off but you get that  Going to buy back today depending on what the US market does for another heavy discount.

Going to buy back today depending on what the US market does for another heavy discount.

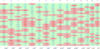

Almost ready to pull the trigger on trades in the US...just waiting for a day of the market going up and the VIX drops down below 30. This is the weekly performance of the spread trades I've been looking at:

Week 17 is this week, up until the open today. Most of the people who are selling right now are retail traders who are scared about losing money - the institutions and hedge funds aren't selling at all. The question I have is the same that Warren Buffett has - if you're buying a company, which is what you are doing when you are buying stocks, exactly what is it about a virus that makes you go 'Oh shit, this company that I've invested in isn't a good buy anymore!'

Now, some of them I wouldn't bother with at all (or might take the reverse position)...I'm only looking at the top four performers...but even if you bought into all 28 trades, do you think you'd take 1.07% increase when the market has plunged 10%?

This is why hedge traders make money in a bear market while retail traders provide the liquidity to get into great deals for later on. Remember when people were saying how hedge funds under-performed the index?

They're singing a different tune now

Almost ready to pull the trigger on trades in the US...just waiting for a day of the market going up and the VIX drops down below 30. This is the weekly performance of the spread trades I've been looking at:

Week 17 is this week, up until the open today. Most of the people who are selling right now are retail traders who are scared about losing money - the institutions and hedge funds aren't selling at all. The question I have is the same that Warren Buffett has - if you're buying a company, which is what you are doing when you are buying stocks, exactly what is it about a virus that makes you go 'Oh shit, this company that I've invested in isn't a good buy anymore!'

Now, some of them I wouldn't bother with at all (or might take the reverse position)...I'm only looking at the top four performers...but even if you bought into all 28 trades, do you think you'd take 1.07% increase when the market has plunged 10%?

This is why hedge traders make money in a bear market while retail traders provide the liquidity to get into great deals for later on. Remember when people were saying how hedge funds under-performed the index?

They're singing a different tune now