- Moderator

- #451

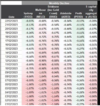

Both US and Canada hiked earlier and harder

Thanks, that is what I'm looking for.

As I mentioned in a previous post, the biggest indicator of what's coming for Australian rates is what the Fed has done and will do, Australia can't afford to fall behind.