- Jul 16, 2003

- 1,858

- 2,384

- AFL Club

- Hawthorn

- Other Teams

- Keilor Bowls Club

Yes. I salary sacrifice as much as I can into my SMSF while staying below the concessional contributions cap.Anyone throw extra money into their Super?

If so has it been worthwhile as opposed to other investment options etc etc

I’d much rather pay 15% tax on my salary as super contributions than pay the marginal tax rate on taxable income.

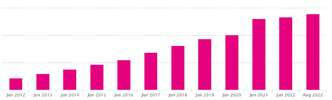

As for the second question, it’s hard to say. Super is a conservative investment approach, but my wife and I have grown the balance of our SMSF by 250% since it’s inception in May 2012. We also purchased an industrial property for her business to operate from so the asset mix is property heavy compared to most funds. While the property hasn’t appreciated significantly in value, the income yield has been reasonable; and it’s allowed her to operate her business while it pays rent to our fund. The current asset mix is 55/35/10 shares/property/cash.