This idiotic trope.We weren’t buying houses with home theatres, en suites and garaging for 4 cars

We were (and this is true of my siblings and in laws at the time) buying war service and ex housing trust homes.

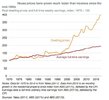

There’s one reason houses are dearer now.

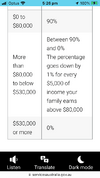

Our mortgage was based on my income alone and repayments could not exceed 30% of gross monthly income.

People who buy these houses aren’t on minimum wage / low income.

People who buy a house with a four car garage and theatre room do so as they make an income that coincides with this level of spend.

My dad bought his first house in subi, 4 bed, 1 br outdoor toilet and he was studying full time and working part time, mum was a part time hairdresser.

It’s not the same.