- Moderator

- #5

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

-

BigFooty AFLW Notice Img

BigFooty AFLW Notice Img

AFLW 2024 - Round 10 - Chat, game threads, injury lists, team lineups and more.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Official Club Stuff 2022 Financial Results

- Thread starter Ports1870

- Start date

- Tagged users None

I seem to remember thinking at the AGM in February that the $9m of debt on the graphic was lower than in the dark days of 2013…. I also seem to remember them saying the plan was to be debt free in 5years with $2m to be paid off this year. I pretty sure I posted that, but can’t find the thread.

$2.5m is more then expected, which is positive. But you can spin results however you want them.

$2.5m is more then expected, which is positive. But you can spin results however you want them.

RussellEbertHandball

Flick pass expert

I seem to remember thinking at the AGM in February that the $9m of debt on the graphic was lower than in the dark days of 2013…. I also seem to remember them saying the plan was to be debt free in 5years with $2m to be paid off this year. I pretty sure I posted that, but can’t find the thread.

$2.5m is more then expected, which is positive. But you can spin results however you want them.

More of the slides at

Official Club Stuff - Port Adelaide FC AGM 2022

Here is the link for the AGM that starts in a few minutes. This might as well be the comments thread about AGM. https://vimeo.com/event/1831844/videos/676157943/

Koch's slide on debt levels. Other slides at

Official Club Stuff - 2021 Financial Results

Before I talk about what was said in the AGM I want to refer back to post number 98, and in my answer to Kingfish73, I wrote We are building $30mil of assets. $17mil comes from governments and $13mil has to be found from members, sponsors and partners. We are told that funding gap has been...

Janus

Advocatus Diaboli

- Sep 9, 2007

- 23,416

- 57,304

- AFL Club

- Port Adelaide

- Other Teams

- Dallas Cowboys, Chicago Bulls

2019 we were missing Dixon for half the year, just like we did in 2022, and we didn't have the 2022 version of Marshall. Our best performing key forward at that point was Westhoff. We were also playing three rookies in our best 22.I'd argue any ability to blame the list disappeared at the end of 2017. 2018 and 2019 we had a great list, we just underperformed to the extent that its been brushed off.

2018 we would have made finals had Dixon not broken his leg. We were up by a number of goals against West Coast at home and cruising, then Dixon comes off, which meant that McGovern could swing forward and kick the winning goal. We brought in Watts to be pretty much what Finlayson is for us now, but Watts was never going to be the main guy.

The reason I say in two years is because while I give 2022 a mulligan for injuries to Dixon, Lycett, Fantasia et al, there's a certain point where even injuries to players can be attributed to the coach just being unlucky.

Hinging success on literally one player.

No wonder why we will never win a flag under this bloke

No wonder why we will never win a flag under this bloke

RussellEbertHandball

Flick pass expert

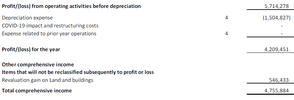

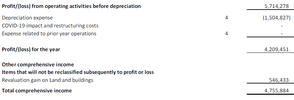

When I looked at the 2021 financial results thread the OP had this screen shot.

Below is this year's announcement.

So if Koch and co have been consistent then our operating profit of $3.463m was after depreciation of about $1.5m which is a lot better result than I expected.

Last year the result was

So an operating profit of $4,209,451 in 2021 is after depreciation so $3,463,552 in 2022 must be after depreciation. That's a lot better than I expected. I expect around $4mil before depreciation.

Depreciation has been $1mil+ per year for several years it might have been $1.5m last year because of stuff written off to start building the museum and the retail store plus early works on upstairs section of The Port Club. It was $1.5m in 2020 as well.

But something still isn't right/explained well. If comprehensive income / statutory profit is $7.017m after grants then net assets should have increased from $14.906m to $21.923m but below says only $17.1m.

Its got to be related to the redevelopment.

Below is this year's announcement.

So if Koch and co have been consistent then our operating profit of $3.463m was after depreciation of about $1.5m which is a lot better result than I expected.

Last year the result was

So an operating profit of $4,209,451 in 2021 is after depreciation so $3,463,552 in 2022 must be after depreciation. That's a lot better than I expected. I expect around $4mil before depreciation.

Depreciation has been $1mil+ per year for several years it might have been $1.5m last year because of stuff written off to start building the museum and the retail store plus early works on upstairs section of The Port Club. It was $1.5m in 2020 as well.

But something still isn't right/explained well. If comprehensive income / statutory profit is $7.017m after grants then net assets should have increased from $14.906m to $21.923m but below says only $17.1m.

Its got to be related to the redevelopment.

Attachments

El Zorro

狐狸

I would take another 5 years of average results onfield if that allows us to be debt-free and masters of our own destiny after that. But I doubt that's the value proposition.

chiwigi

I’ll make tears from your Wines.

If that’s the master plan I’m ok with that, but surely it’s not. It’s also ridiculously risky with the fan base.I would take another 5 years of average results onfield if that allows us to be debt-free and masters of our own destiny after that. But I doubt that's the value proposition.

It does seem like they are steering that way with the coaching line up etc. splitting the difference I’d guess.

tribey

ʎǝlʞuᴉH ʞɔɐS

I would take another 5 years of average results onfield if that allows us to be debt-free and masters of our own destiny after that. But I doubt that's the value proposition.

We’re probably due some clarification as to what the deal is given the club will effectively be debt-free by 2025.

Returning to proper autonomy in keeping with the game’s other century plus-old institutions is a must.

TeeKray

Moderator

- Moderator

- #60

The debt is not ideal but has never been my biggest concern (admittedly it's become more concerning with the cost of finance rapidly increasing this year). The debt to equity ratio is hardly out of control, our balance sheet is still reasonably healthy.

Bigger concern to me has always been revenue growth. That's ultimately the path to financial strength. Mid teens revenue growth looks excellent but it's hard to really know without the specifics, especially given we're cyclying a somewhat covid affected year.

Bigger concern to me has always been revenue growth. That's ultimately the path to financial strength. Mid teens revenue growth looks excellent but it's hard to really know without the specifics, especially given we're cyclying a somewhat covid affected year.

It’s hard to take much from this without knowing our salary and soft cap spend.

Sounds great until ya think about ports fan base... Happy clappers... True believers...I would take another 5 years of average results onfield if that allows us to be debt-free and masters of our own destiny after that. But I doubt that's the value proposition.

- Jun 7, 2015

- 7,529

- 14,975

- AFL Club

- Port Adelaide

All this talk of debt is bullshit as it makes you think we are in a poor position financially.

We have loans.

We have $17.1 million in net assets.

We are ahead by $17.1 million.

What I'm interested in is how much of that $30 million of redevelopment is covered by grants etc.

Are we forking out the other $27 million when the redevelopment is complete this year?

Does that leave us with $10.0 million of net liability?

We have loans.

We have $17.1 million in net assets.

We are ahead by $17.1 million.

What I'm interested in is how much of that $30 million of redevelopment is covered by grants etc.

Are we forking out the other $27 million when the redevelopment is complete this year?

Does that leave us with $10.0 million of net liability?

- May 16, 2019

- 3,903

- 7,741

- AFL Club

- Port Adelaide

My biggest concern is we have a shit coach and a very suspect list under real pressure.The debt is not ideal but has never been my biggest concern (admittedly it's become more concerning with the cost of finance rapidly increasing this year). The debt to equity ratio is hardly out of control, our balance sheet is still reasonably healthy.

Bigger concern to me has always been revenue growth. That's ultimately the path to financial strength. Mid teens revenue growth looks excellent but it's hard to really know without the specifics, especially given we're cyclying a somewhat covid affected year.

RussellEbertHandball

Flick pass expert

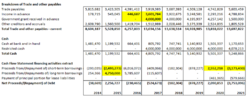

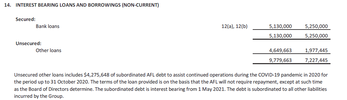

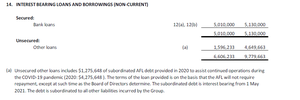

Who bloody knows, is the right answer.So $6.5 mill in total debt?

I have taken Koch's debt slide from last year's AGM and put up info from Port's financials to try and reconcile the two. But every year there are substantial differences.

It looks like Interest bearing debt figures + lease liabilities is the figure Koch used in 2021 but I can't be 100% sure of that.

We acquired some major leased asset in 2021 after having to create the asset and liability in 2020 due to accounting rule changes.

Port's financials have 4 liability amounts. I have revealed 3 of them below. The 4th is provisions which is just employee entitlements for annual leave, long service leave and any other leave.

I reckon part of our Accounts Payable from 8-10 years ago was $2-$3million the AFL lent us/paid expenses on our behalf during 2011 to 2014 period.

The 30 June 2011 funding deal when the SANFL threatened to take us over and the AFL stepped in, said the AFL would lend monies to the SANFL who had to fund us with a $2mil grant per year for 3 years, so no debt had to be repaid by Port as they were grants, previously guaranteed by the SANFL, which the SANFL had to pay back to the AFL when they sold Footy Park. The full details of the deal including SANFL supporting the crows for 3 years can be read - HERE

We still had cash flow issues, and getting to AO required a lot of new expenses and the AFL wanted it to be a big success, so the most logical explanation of this discrepancy, especially in the early years of this slide below, is that debts to the AFL were categorised as Accounts Payable as they were effectively interest free loans from the AFL.

Gordon Pickhard also lent us $1million interest free and I have no idea how much of this has been paid off and when amounts were paid off. This was probably also classified as Accounts Payable.

In 2017 you can see Income in Advance increased by over $3mil this was due to moving renewals from 17th November to 17 October. If we didn't do this then $805k cash at bank and in hand would be an overdraft of $2.2mil. The $4mil government grant for the PA Aboriginal Centre of Excellence was banked in 2017 year until 2021 when according to the Cash flow statement $4,635,829 was repaid to the feds on cancellation of that project.

In 2020 Income in Advance was still $2.293mil but bugger all would have been from members as renewal was 24th November 2020 so i reckon its sponsors and corporates paying in advance earlier than normal. KT, Koch, and Richo all talked about our sponsors being incredibly supportive and helping us out during Covid.

However in 2021 restricted cash was still $4.078mil. It was made up of 2 components. $1.5mil received from the state government to redevelop the Williams Stand for AFLW that hadn't been spent by 31st October, and this mystery amount relating to the JV company set up with Shanghai CRED re the China game and other China activites.

In 2020 we borrowed $4.275mil from the AFL to survive Covid as per this note from the 2020 accounts.

2021 note explains how much we paid off.

Re the loan from the AFL between 20211 and 2014 years if you look at 2018 accounts, the Cash Flow statement says the club only paid off $182k of debt, yet debt increased by just over $2mil. This note from 2018 where the unsecured long term debt increases by $2.1m suggets to me the AFL loan that was previously included as Accounts Payable was moved to debt.

Or its China related and its Mr Gui or someone else, but because its not going thru the cash flow statement it looks like a book entry to me. Maybe we racked up a whole lot of payables due to China which basically replaced the movement of AFL amount from payables to debt given the payables figure only decreased from $3.91mil to $3.68mil

2018 Financial Statements Note

How much debt do we have?? I guess the same sort of answer as how long is a piece of string.

Last edited:

FishingRick04

Brownlow Medallist

Personally I don't get the debt free to be masters of our destiny. A business of this size should have some gearing to assist in growth. relying solely of cash will make growth strategies slower.

If it's AFL debt holding us back, do a deal with banksa (one of our partners) to replace the AFL debt with their debt and we should be free to do as we will!

If it's AFL debt holding us back, do a deal with banksa (one of our partners) to replace the AFL debt with their debt and we should be free to do as we will!

TeeKray

Moderator

- Moderator

- #68

Personally I don't get the debt free to be masters of our destiny. A business of this size should have some gearing to assist in growth. relying solely of cash will make growth strategies slower.

If it's AFL debt holding us back, do a deal with banksa (one of our partners) to replace the AFL debt with their debt and we should be free to do as we will!

At risk of coming across as condescending, the average AFL fan wouldn't have much of a background in finance and business. All of the conversations around being debt free and debt reduction are an easy sell to the masses. You can see in this thread that is 90% of the focus. Most annual reports I read have very little discussion around debt. Revenue growth is the key to everything. Healthy companies are always growing revenue faster than expenses. If you do that then everything else takes care of itself.

RussellEbertHandball

Flick pass expert

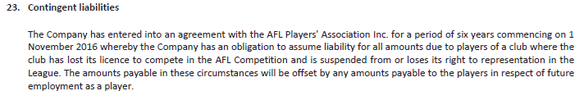

The AFL has given a guarantee to our bankers for $5.0m and has for many years and lists it under their contigent liabilities note in their annual report.Personally I don't get the debt free to be masters of our destiny. A business of this size should have some gearing to assist in growth. relying solely of cash will make growth strategies slower.

If it's AFL debt holding us back, do a deal with banksa (one of our partners) to replace the AFL debt with their debt and we should be free to do as we will!

For years we couldn't technically operate as a going concern without it.

Our debt was accumulated out of losses, not going out to borrow to buy an asset to build the business.

There is nothing wrong to borrow large sums of debt to buy/build an income producing asset,

Hawthorn did it for their Caroline Springs pokie venue, borrowed $12m to buy machines and fit out that leasehold venue as well as machines for their other venue Vegas Club in Mulgrave in 2010 when the Vic pokie duopoly was broken up. They then generated profits of between $2m-$4m a year and then mid this year they sold off both venues and after paying off outstanding debt of about $8m they netted just over $40m. They paid their debt off slowly when their asset was making large returns in a low interest environment.

That's the sort of large debt you want.

Its not the debt pursue, its the AFL oversight that is the issue. Being debt free means less oversight from the AFL as they don't have to give your bankers a guarantee to operate, and maybe one day, like the Crows have in their constitution, post 31/10/2028 they get out of their hair, and will get out of ours and we have more member elected directors and more say in our club.

From page 35 of the AFL's 2021 annual report lodged with ASIC.

bomberclifford

Importer/Exporter

Austerity mode.

Reduce largest areas of cost to bare minimum.

Reduce the service offering to minimum viable product level.

Use grants and donations to develop assets.

Pay down debt in large chunks.

Act like a hero and point to the bottom line.

Meanwhile, Melbourne, Fremantle, Brisbane, and potentially Carlton all move past us in the on field stakes.

Yay.

See you at the Precinct.

Reduce largest areas of cost to bare minimum.

Reduce the service offering to minimum viable product level.

Use grants and donations to develop assets.

Pay down debt in large chunks.

Act like a hero and point to the bottom line.

Meanwhile, Melbourne, Fremantle, Brisbane, and potentially Carlton all move past us in the on field stakes.

Yay.

See you at the Precinct.

The AFL has given a guarantee to our bankers for $5.0m and has for many years and lists it under their contigent liabilities note in their annual report.

For years we couldn't technically operate as a going concern without it.

The average Port fan also sees our debt as a hammer that is used to bash us (media/other fans) and control us (afl). We've had a gut full of being described as 'taker', and that being used as a reason to deny us having control over our own identity, getting a shit sandwich with free to air tv coverage, amongst other things.At risk of coming across as condescending, the average AFL fan wouldn't have much of a background in finance and business. All of the conversations around being debt free and debt reduction are an easy sell to the masses. You can see in this thread that is 90% of the focus. Most annual reports I read have very little discussion around debt. Revenue growth is the key to everything. Healthy companies are always growing revenue faster than expenses. If you do that then everything else takes care of itself.

TeeKray

Moderator

- Moderator

- #73

Austerity mode.

Reduce largest areas of cost to bare minimum.

Reduce the service offering to minimum viable product level.

Use grants and donations to develop assets.

Pay down debt in large chunks.

Act like a hero and point to the bottom line.

Meanwhile, Melbourne, Fremantle, Brisbane, and potentially Carlton all move past us in the on field stakes.

Yay.

See you at the Precinct.

Known as 'doing a North Melbourne'.

bomberclifford

Importer/Exporter

Known as 'doing a North Melbourne'.

Bleaugh.

- Moderator

- #75

The AFL has given a guarantee to our bankers for $5.0m and has for many years and lists it under their contigent liabilities note in their annual report.

For years we couldn't technically operate as a going concern without it.

Our debt was accumulated out of losses, not going out to borrow to buy an asset to build the business.

There is nothing wrong to borrow large sums of debt to buy/build an income producing asset,

Hawthorn did it for their Caroline Springs pokie venue, borrowed $12m to buy machines and fit out that leasehold venue as well as machines for their other venue Vegas Club in Mulgrave in 2010 when the Vic pokie duopoly was broken up. They then generated profits of between $2m-$4m a year and then mid this year they sold off both venues and after paying off outstanding debt of about $8m they netted just over $40m. They paid their debt off slowly when their asset was making large returns in a low interest environment.

That's the sort of large debt you want.

Its not the debt pursue, its the AFL oversight that is the issue. Being debt free means less oversight from the AFL as they don't have to give your bankers a guarantee to operate, and maybe one day, like the Crows have in their constitution, post 31/10/2028 they get out of their hair, and will get out of ours and we have more member elected directors and more say in our club.

From page 35 of the AFL's 2021 annual report lodged with ASIC.

View attachment 1574060

View attachment 1574059

Not all of these guarantees have been used. Essendons isnt drawn, I dont think Carlton or Footscrays are either.

Similar threads

- Replies

- 3

- Views

- 723

- Replies

- 2

- Views

- 465

- Replies

- 10K

- Views

- 289K

- Replies

- 23

- Views

- 1K

- Replies

- 31

- Views

- 3K