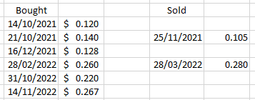

Briefly mentioned near the start.My 1 week gain could have been 25% instead of 20%

/Jokes - I'm not unhappy!

In trading halt today so not sure which way it goes from here

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

-

Mobile App Discontinued

Due to a number of factors, support for the current BigFooty mobile app has been discontinued. Your BigFooty login will no longer work on the Tapatalk or the BigFooty App - which is based on Tapatalk.

Apologies for any inconvenience. We will try to find a replacement. -

Fantasy Footy Notice Image Round 20

Fantasy Footy Notice Image Round 20

Supercoach Rd 20 SC Talk - Trade Talk - Capt/VC - BigFooty Cup - Quarter Finals - Last Coach Standing - Final 6 ,//, AFLW Fantasy 2025! ,//, AFL Fantasy Rd 20 AFF Talk Rd 20 - AF Trades - Captains/VCs

-

Mobile App Discontinued

Due to a number of factors, support for the current BigFooty mobile app has been discontinued. Your BigFooty login will no longer work on the Tapatalk or the BigFooty App - which is based on Tapatalk.

Apologies for any inconvenience. We will try to find a replacement.

General Markets Talk

- Thread starter Jimmy_the_Gent

- Start date

- Tagged users None

🥰 Love BigFooty? Join now for free.

Falchoon

Hall of Famer

- Feb 15, 2002

- 30,204

- 11,884

- AFL Club

- St Kilda

- Other Teams

- Bluestar Airlines, Anacott Steel

Briefly mentioned near the start.

Yeah, I like these guys and Carl from thinkmarkets.

I've never acted on anything they have said but after listening for quite a while they seem to be right a fair bit more than wrong.Yeah, I like these guys and Carl from thinkmarkets.

Log in to remove this Banner Ad

Falchoon

Hall of Famer

- Feb 15, 2002

- 30,204

- 11,884

- AFL Club

- St Kilda

- Other Teams

- Bluestar Airlines, Anacott Steel

Does anyone use the platform Stake and have any opinions on it? $3 brokerage is very very tempting.

I have no opinion, but it is Chess sponsored so you own the stock.

That pay cheque a is looking better alreadyI put this month's pay cheque into RNU at 26.7 today.

Falchoon

Hall of Famer

- Feb 15, 2002

- 30,204

- 11,884

- AFL Club

- St Kilda

- Other Teams

- Bluestar Airlines, Anacott Steel

That pay cheque a is looking better already

It's nice to be right every now and then.

I bought RNU

I bought RNU at 33.6 cents. I’m sitting on a tidy .3% profit right nowIt's nice to be right every now and then.

Falchoon

Hall of Famer

- Feb 15, 2002

- 30,204

- 11,884

- AFL Club

- St Kilda

- Other Teams

- Bluestar Airlines, Anacott Steel

Not just that assess to a lot of cap raises as 'sophisticated investors' where you as even an actual shareholder of the thing can't even participate.So yesterday evening I found out that in order to get access to early stages IPOs I would need both at least $2,500,000 in assets and at least two years consecutively earning $250,000 or more.

... and the rich get richer

Forgot the name of it section something, a family member has it and even they say it's absolute BS.

Taylor

Community Leader

- Moderator

- #3,764

Not just that assess to a lot of cap raises as 'sophisticated investors' where you as even an actual shareholder of the thing can't even participate.

Forgot the name of it section something, a family member has it and even they say it's absolute BS.

I know Power Raid has been pretty vocal about this before.

All those retail level investors who own stock in a company get bypassed to offer new shares in a cap raise at a whopping discount to the already loaded who can flip that money for a 20% return in a week.

I was looking into it with a view to setting up a collective, like a power mum investor group, to be able to take advantage of offers as they come along and maybe turn that fund into a plus 15% per year (conservatively) slash more day trading than my current long term growth strategy but the threshold for entry is so damn high.

Yeah he trades it mostly. Thing is it's mostly all the small time spec stuff that's risky and when they come up you have to make your decision to participate quickly. It's a big advantage but still not for the faint hearted.I know Power Raid has been pretty vocal about this before.

All those retail level investors who own stock in a company get bypassed to offer new shares in a cap raise at a whopping discount to the already loaded who can flip that money for a 20% return in a week.

I was looking into it with a view to setting up a collective, like a power mum investor group, to be able to take advantage of offers as they come along and maybe turn that fund into a plus 15% per year (conservatively) slash more day trading than my current long term growth strategy but the threshold for entry is so damn high.

I punt on small stuff but imo the easiest way to do well long term is to buy solid growth mid cap or larger and hold. Boring but the safest, least work involved and it's simply effective and you can't lose your shirt.

Power Raid

We Exist To Win Premierships

Not just that assess to a lot of cap raises as 'sophisticated investors' where you as even an actual shareholder of the thing can't even participate.

Forgot the name of it section something, a family member has it and even they say it's absolute BS.

the s708 rules in the Corps Act are designed to "protect" retail investors where in reality they penalise investors. ie only offers that can't be filled by sophisticated investors are offered to retail.

So it's like "we have this great offer and we don't want to spend $250k-$500k and 3 months preparing paperwork, so we will fill it with sophisticated investors that don't require an offer document" or

"we have this shit offering and sophisticated investors don't want it because of the risk, the pricing, management or strategy but here retail "fill your boots"

There are other exceptions in s708 that allow retail to participate in sophisticated offers but the risk is too high, so companies and brokers simply don't take the chance.

but this is how dumb "professional and sophisticated" actual is:

1) you have the IQ of a pigeon, you have no experience in investing, you wet the bed each night but you have a large income or large wealth..............yep you're sophisticated and can get special deals

2) you're a shareholder of the company, you have decades of experience investing in the sector, you've worked in the sector, you have a Harvard Phd on the sector but you don't have a large income or assets...............nup, you can't follow on your investment

This is an example how the government creates a glass ceiling on wealth and opportunity for the ordinary

Power Raid

We Exist To Win Premierships

I know Power Raid has been pretty vocal about this before.

All those retail level investors who own stock in a company get bypassed to offer new shares in a cap raise at a whopping discount to the already loaded who can flip that money for a 20% return in a week.

I was looking into it with a view to setting up a collective, like a power mum investor group, to be able to take advantage of offers as they come along and maybe turn that fund into a plus 15% per year (conservatively) slash more day trading than my current long term growth strategy but the threshold for entry is so damn high.

our fund has been operating since 1997 and the worst return in a year was 27% and the highest 38% with an average of 33%. This despite being focused on the resources space which is notoriously volatile.

It is achieved through getting the deals first and at discounts to market. We also don't invest unless we see an 85% return on equity investments........that doesn't mean we get 85% but we don't proceed with equity unless we see that opportunity.

We also use notes where we generate a 10% yield plus an equity kicker. So we have down side protection being secured or unsecured, a yield and options or conversion rights for equity upside.

Retail can't do the same as the law doesn't allow it. They can't even buy into our fund......as the law won't allow it.

Taylor

Community Leader

- Moderator

- #3,768

our fund has been operating since 1997 and the worst return in a year was 27% and the highest 38% with an average of 33%. This despite being focused on the resources space which is notoriously volatile.

It is achieved through getting the deals first and at discounts to market. We also don't invest unless we see an 85% return on equity investments........that doesn't mean we get 85% but we don't proceed with equity unless we see that opportunity.

We also use notes where we generate a 10% yield plus an equity kicker. So we have down side protection being secured or unsecured, a yield and options or conversion rights for equity upside.

Retail can't do the same as the law doesn't allow it. They can't even buy into our fund......as the law won't allow it.

I was just about to ask if there was a capability to facilitate the creation of a new sub fund using your fund's ticket into the party and some arrangement where you carry no risk.

But the law has to keep me safe.

2.5m in assets and 2x 250k earned to get in the door is a high bar to jump.

It feels like when you cross the threshold into rich rich the snowball just flies along. That first million takes a while but the ones after come much faster.

I'm quite livid about this. I don't need to be protected.

Power Raid

We Exist To Win Premierships

I was just about to ask if there was a capability to facilitate the creation of a new sub fund using your fund's ticket into the party and some arrangement where you carry no risk.

But the law has to keep me safe.

2.5m in assets and 2x 250k earned to get in the door is a high bar to jump.

It feels like when you cross the threshold into rich rich the snowball just flies along. That first million takes a while but the ones after come much faster.

I'm quite livid about this. I don't need to be protected.

I can understand from a state point of view that provides a pension, to place restrictions so super and near retirement funds are not at risk

but young people SHOULD be going hard and taking risks, to quickly amass a deposit on a house

obviously I am in the camp of the state does not need to get involved at all though. Especially when the regulator is ASIC, who don't know that resources includes mining and don't even know their own regulations.

The ATO is an amazing organisation to deal with but ASIC is the worst. How are we supposed to have good corporate governance if the regulator is incompetent?

🥰 Love BigFooty? Join now for free.

Power Raid

We Exist To Win Premierships

Can I ask what your average investment package size is when you are jumping into one of these opportunities?

Is there a minimum buy in?

We back management teams, then the asset and then the value

so if a top quality management team comes in and says "we have moose pasture in a war zone" we would give them $250k. When they achieve something we would follow on with $2m, then $10m and then the mezzanine ($30m) of project finance ($100m).

The $250k is a loss leader, the $2m you can start to guess, the $10m is heading towards or achieved feasibility. At each of these stages you not only get exposure to the investment but you earn 6% on managing the capital raise.

ie they want $10m, you give them $2m but raise $8m meaning you get $600k commission.

The cream is the mezz and or project finance as this is where you lock away returns from the hedge book on the commodity, the diesel, the FX and or take the commission on structuring the entire finance.

On the mezz you put in $30m and take security and the first right of refusal on the project finance and equity rights (say the right to buy shares at $1 for 5 years). You get say 4% on providing the $30m, so you get $1.2m. You build a project finance book of $300m of which you write a cheque for $100m. You get 2% on $300m being $6m. You take a commission on the hedge book which varies dramatically but the turnover is massive so the fee is healthy AND you still have the equity rights from the mezz despite getting your mezz capital repaid.

You then sell the project finance book as the return is too low but you have the hedge book and the mezz equity rights, thus generate returns on no capital investment.

You don't get the mezz and project finance opportunity unless you back them early. They also don't come back unless you treat them fairly throughout the journey and risk losing quality management if you're greedy or aggressive.

Goldmans was busy today on Lithium, telling clients to buy Alkane (ASX: ALK) +1.61%, Hold Pilbara (ASX: PLS) -4.88%, IGO limited (ASX: IGO) -4.12% & Liontown (ASX: LTR) -7.49% while they called Core Lithium (ASX: CXO) -9.92% a sell.

They think prices will be lower in FY23 so prefer the producers, although the composition of their calls clearly shows they are bearish the sector – a topic we flagged this morning.

They think prices will be lower in FY23 so prefer the producers, although the composition of their calls clearly shows they are bearish the sector – a topic we flagged this morning.

Mofra

Moderator

- Dec 6, 2005

- 73,124

- 215,234

- AFL Club

- Western Bulldogs

- Other Teams

- Footscray, Coney Island Warriors

- Moderator

- #3,775

BNP Paribas studied 100 years of market crashes — here's what it says is coming next

Strategists at the French bank are expecting a capitulation event next year in the stock market.

Watch on June next year as a LT buying opportunity