Tonga Bob

Getting warmer

- Oct 26, 2013

- 31,322

- 77,618

- AFL Club

- Fremantle

- Other Teams

- SFFC, LFC, ADO, CI Warriors

- Moderator

- #1

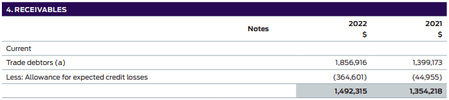

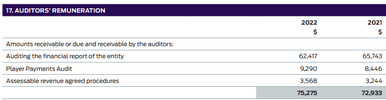

$2.43M profit in 2022

Fremantle post $2.43m profit

The Fremantle Football Club has posted a 2022 operating profit of $2.43m, which compares to a profit of $1.55m for 2021.