An indebted population is a compliant one.‘Mortgage debt’ - just how they like us (the system that is).

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Opinion Domestic Politics BF style

- Thread starter bomberclifford

- Start date

- Tagged users None

Pauline Hanson was being diplomatic when she suggested that Senator Faruqi should piss off back to Pakistan:

bomberclifford

Importer/Exporter

Someone leaked the quiet part to friendlyjordies

Regardless of what you think of Jordan

The commentary from Gina and Dutton is very far from

Labor and liberal are the same

Regardless of what you think of Jordan

The commentary from Gina and Dutton is very far from

Labor and liberal are the same

- Mar 1, 2014

- 14,639

- 18,568

- AFL Club

- Port Adelaide

- Other Teams

- Cronulla Sutherland Sharks

The move to a cashless society took a turn for me today. At the local butcher shop they display a sign which states that 'all tap and go card transactions will incur a 1.1% surcharge unless the card is inserted and a PIN used'. When I attempted to do this I was told that as the transaction was under $25.00 the Debit Card fee would be higher if I inserted my card. We are talking a piddling amount as the transaction was less than $10.00 but the point is this, that condition is not explained on the sign at the point of sale and had I followed the instruction I would actually have paid a higher surcharge while believing that I was avoiding any surcharge.

I am not sure how a surcharge on card transactions has been allowed to resurface. Some years ago the card companies tried a similar thing and the surcharge was quashed by the Government of the day. Given their concern over the high cost of living maybe it is time for the present Government to look at the situation. At face value a surcharge of approximately1.1% may not appear to be much but if it is added to all card purchases it adds to the inflation rate and the cost of living. You have to wonder how many surcharges we incur through wave and pay card transactions without realising it.

I guess that the moral in the story is to pay cash while we still can.

FOOTNOTE:

Apparently the RBA is conducting a review into Debit Card surcharge rates and the Albanese Government will act on that revue. Any bans on card surcharges will not come into place until 2026. If we are waiting on the RBA this could take some time. The problem for the Reserve Bank is of course that businesses charge a fee to offset the cost of bank fees on card transactions. If the surcharge is stopped business may build a service fee into retail prices and this will in turn fuel inflation. The solution may be to pay cash and avoid the surcharge.

www.abc.net.au

www.abc.net.au

I am not sure how a surcharge on card transactions has been allowed to resurface. Some years ago the card companies tried a similar thing and the surcharge was quashed by the Government of the day. Given their concern over the high cost of living maybe it is time for the present Government to look at the situation. At face value a surcharge of approximately1.1% may not appear to be much but if it is added to all card purchases it adds to the inflation rate and the cost of living. You have to wonder how many surcharges we incur through wave and pay card transactions without realising it.

I guess that the moral in the story is to pay cash while we still can.

FOOTNOTE:

Apparently the RBA is conducting a review into Debit Card surcharge rates and the Albanese Government will act on that revue. Any bans on card surcharges will not come into place until 2026. If we are waiting on the RBA this could take some time. The problem for the Reserve Bank is of course that businesses charge a fee to offset the cost of bank fees on card transactions. If the surcharge is stopped business may build a service fee into retail prices and this will in turn fuel inflation. The solution may be to pay cash and avoid the surcharge.

Debit card surcharges to be scrapped by 2026, government promises

There is an end in sight for consumers getting hit with sneaky surcharges when they pay on card, with the federal government prepared to ban the practice by 2026, promising to give consumers and small businesses "a fair go."

Last edited:

Interesting table posted by former SA Senator Rex Patrick on the eye watering salaries (and salary hikes) of the top politicians and bureaucrats/judges at the Federal level.

Made even worse when you consider that is just ONE level of the bureaucracy and it's replicated at the State and Local level.

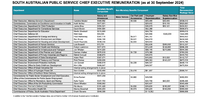

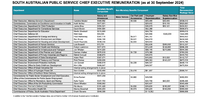

Take a look at the salaries of South Australian fat cats. Take note of the salary sacrifice numbers column as well with many of the ageing CE's taking advantage of sacrificing large chunks of their pre-tax salary to sweeten their post retirement bank accounts.

Can't bothered looking up how much money is being spent on the salaries of the CEOs of the 68 local councils in South Australia (the CEOs of most metro councils get around $470k), and other statutory bodies, govt boards and committees but you get the picture. And the salary of the SA Governor has just been increased by $85k, bringing her into line with the amount paid to every other state Governor (median salary across all states $520k).

Not news but the fact we are over-governed in this little country of ours comes at a whopping up front cost to taxpayers.

Made even worse when you consider that is just ONE level of the bureaucracy and it's replicated at the State and Local level.

Take a look at the salaries of South Australian fat cats. Take note of the salary sacrifice numbers column as well with many of the ageing CE's taking advantage of sacrificing large chunks of their pre-tax salary to sweeten their post retirement bank accounts.

Can't bothered looking up how much money is being spent on the salaries of the CEOs of the 68 local councils in South Australia (the CEOs of most metro councils get around $470k), and other statutory bodies, govt boards and committees but you get the picture. And the salary of the SA Governor has just been increased by $85k, bringing her into line with the amount paid to every other state Governor (median salary across all states $520k).

Not news but the fact we are over-governed in this little country of ours comes at a whopping up front cost to taxpayers.

Last edited:

Plus there is no superannuation concessional cap on these state government positions allowing them to salary sacrifice well above the $30,000 concessional limit. For example, look at Matt Opie who's drawing a salary of $50K while salary sacrificing $350K pre-tax into super which then gets taxed at a concessional rate of 15% instead of the normal income tax rate (which would be 45% for the bulk of his salary).Interesting table posted by former SA Senator Rex Patrick on the eye watering salaries (and salary hikes) of the top politicians and bureaucrats/judges at the Federal level.

View attachment 2194778

Made even worse when you consider that is just ONE level of the bureaucracy and it's replicated at the State and Local level.

Take a look at the salaries of South Australian fat cats. Take note of the salary sacrifice numbers column as well with many of the ageing CE's taking advantage of sacrificing large chunks of their pre-tax salary to sweeten their post retirement bank accounts.

View attachment 2194773

Can't bothered looking up how much money is being spent on the salaries of the CEOs of the 68 local councils in South Australia (the CEOs of most metro councils get around $470k), and other statutory bodies, govt boards and committees but you get the picture. And the salary of the SA Governor has just been increased by $85k, bringing her into line with the amount paid to every other state Governor (median salary across all states $520k).

Not news but the fact we are over-governed in this little country of ours comes at a whopping up front cost to taxpayers.

Well from a financial perspective the SA Government doesn't care - the income tax concessional tax benefits that comes from doing that is a revenue hit taken solely by the Federal Government. Just a guess, but I reckon the personal tax savings of that salary sacrifice arrangement was probably the carrot that the SA Govt used to get Opie to sign his contract.Plus there is no superannuation concessional cap on these state government positions allowing them to salary sacrifice well above the $30,000 concessional limit. For example, look at Matt Opie who's drawing a salary of $50K while salary sacrificing $350K pre-tax into super which then gets taxed at a concessional rate of 15% instead of the normal income tax rate (which would be 45% for the bulk of his salary).

You'd think they would care about the 'look' of it when most South Australians are in a cost of living crisis though. But afaik this table, published on the Public Service Commissioner's website, has never come under any real scrutiny in the SA media so wgaf eh?

Last edited:

The Federal salaries are realistic. The PM and ministers are responsible for managing millions of people. Even backbenchers for around 50 thousand. The one's which are over the top are department and judges salaries. WTF are advisors / managers for the PM and ministers earning way more than them? They aren't 100k a year jobs, but $300k-$350k, at triple the average wage, would be a good salary and more in line with them versus their bosses.Interesting table posted by former SA Senator Rex Patrick on the eye watering salaries (and salary hikes) of the top politicians and bureaucrats/judges at the Federal level.

View attachment 2194778

Made even worse when you consider that is just ONE level of the bureaucracy and it's replicated at the State and Local level.

Take a look at the salaries of South Australian fat cats. Take note of the salary sacrifice numbers column as well with many of the ageing CE's taking advantage of sacrificing large chunks of their pre-tax salary to sweeten their post retirement bank accounts.

View attachment 2194773

Can't bothered looking up how much money is being spent on the salaries of the CEOs of the 68 local councils in South Australia (the CEOs of most metro councils get around $470k), and other statutory bodies, govt boards and committees but you get the picture. And the salary of the SA Governor has just been increased by $85k, bringing her into line with the amount paid to every other state Governor (median salary across all states $520k).

Not news but the fact we are over-governed in this little country of ours comes at a whopping up front cost to taxpayers.