Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

-

Mobile App Discontinued

Due to a number of factors, support for the current BigFooty mobile app has been discontinued. Your BigFooty login will no longer work on the Tapatalk or the BigFooty App - which is based on Tapatalk.

Apologies for any inconvenience. We will try to find a replacement. -

Mobile App Discontinued

Due to a number of factors, support for the current BigFooty mobile app has been discontinued. Your BigFooty login will no longer work on the Tapatalk or the BigFooty App - which is based on Tapatalk.

Apologies for any inconvenience. We will try to find a replacement.

UK UK general election, July 4

- Thread starter Johnny Bananas

- Start date

- Tagged users None

🥰 Love BigFooty? Join now for free.

- Sep 10, 2010

- 17,330

- 23,955

- AFL Club

- Brisbane Lions

- Thread starter

- #377

With what policy though? Neoliberal economics won't save him.He's got a few years to turn it around.

spinynorman

Norm Smith Medallist

Log in to remove this Banner Ad

- Sep 10, 2010

- 17,330

- 23,955

- AFL Club

- Brisbane Lions

- Thread starter

- #380

He'd have to junk his entire policy agenda up until this point and embrace Corbynism to reverse that. Does anyone think that'll happen? I think it's much more likely that Labour knocks him off as PM if things don't change in a year or two.View attachment 2179077

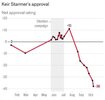

It’s a pretty stunning collapse. To make the point about turnarounds, well, anything is possible, but I don’t know anyone who has bounced back from a level of unpopularity this deep.

Declare war on some tinpot Dictator's country. Venezuela ??With what policy though? Neoliberal economics won't save him.

They had a general election over it. Boris won in 2019.Why did they not reverse Brexit or have another referendum/non-binding survey?

View attachment 2178683

Taken from FACEBOOK"Persecution of farmers"!

Holy f'ing shiz!

- The UK government has maintained subsidies that the EU used to pay to farmers. Before Brexit.

- Brexit was pushed by the people now seeking to avoid inheritance tax by buying farmland.

Things you don't know about the proposed inheritance tax on farms, Todman :

- The proposed inheritance tax on farms is HALF that of any other asset.

- The proposed inheritance tax on farms has a floor of $3 million in asset value.

- The proposed inheritance tax on farms therefore affects very few farmers.

- The proposed inheritance tax on farms is designed to stop rich people buying up land to AVOID inheritance tax.

- The proposed inheritance tax on farms will see excessive farmland prices drop to within reach of more farmers and potential farmers.

England and Wales farmland prices hit record high

Data from sales and lettings agency Knight Frank shows farmland in England Wales was valued at more £9,000 per acre for the first time in Q4 2023.www.agriinvestor.com

Rich tax-dodgers in the UK don't support you financially or politically here in Australia.

Given all of this, I ask you:

Why do you support them?

“My dad is a farmer - single man. The farm has been in the family for a long time - it's worth £4m quid in total. We make £40k per year from the farm.

Dad dies, we get 1m tax free, but suffer 20% of £3m, which is 600k, on the rest. Can't afford it, sell the farm.

I've still got £3.4m. What am I gonna do with it? I buy a property portfolio, driving housing prices up in my local area, and rent it out to you.

Where I used to make a 1% return on my assets, I now make 5%. I am getting richer for doing a lot less, though I have had to give up producing food for you to eat in super markets.

I'm okay, because I'm rich, but Britain either produces less food, or BlackRock produces food for you.

Britain's food supply is gradually more and more controlled by foreign investors, but I can still eat good because I'm rich.

I did try to warn you that this would happen, but you insisted you wanted me gone. So I am currently living in my second home in Spain sipping margaritas and collecting about 10 grand a month from the letting agency.

You are eating bugs. Happy?”

(Anon).

Chief

~ Shmalpha ~

- Admin

- #384

That sounds like the guy who was brought on by the aristocrat landlord "farmer".Dad dies, we get 1m tax free, but suffer 20% of £3m,

He's got his sums wrong.

If the tax forces some rich people to ditch farmland as an inheritance tax dodge, the prices will drop as more land comes on the market.

His land value will then be below the 3mil, from what I understand, and he will pay NO inheritance tax.

None.

Protests against this tax come from people who have owned land for 500 years and might have to pay HALF of the tax everybody else pays.

- Sep 10, 2010

- 17,330

- 23,955

- AFL Club

- Brisbane Lions

- Thread starter

- #385

There's your first problem, dullards share all kinds of inaccurate nonsense there.Taken from FACEBOOK

Were they and their dad really so unintelligent as to not put money aside to cover inheritance tax?“My dad is a farmer - single man. The farm has been in the family for a long time - it's worth £4m quid in total. We make £40k per year from the farm.

Dad dies, we get 1m tax free, but suffer 20% of £3m, which is 600k, on the rest. Can't afford it, sell the farm.

Chief

~ Shmalpha ~

- Admin

- #386

Even if the tax does not push prices back down to normal levels, he could also buy shares, put some in his retirement fund. Whatever.Can't afford it, sell the farm.

I've still got £3.4m. What am I gonna do with it? I buy a property portfolio, driving housing prices up in my local area, and rent it out to you.

And then get a job.

All of this looks at his situation as if nothing else changes.

Chief

~ Shmalpha ~

- Admin

- #388

Note the aristocrat farmer whose family has held onto the land for 500 years and wants to avoid paying even half of the tax everyone else pays on every other class of asset:

It is a cartel of very rich people, looking to dodge tax, harnessing misinformation to whip up panic in people who will not be affected.

Chief

~ Shmalpha ~

- Admin

- #389

And they have 10 years to pay off the tax. Who else gets taxed at a lower rate and gets 10 years to pay it?Were they and their dad really so unintelligent as to not put money aside to cover inheritance tax?

40k off a 3mil asset sounds like a bad investment that they are holding onto for sentimental reasons.

Any other situation and the tax-minimising toffs (Clarkson is a toff no matter what he claims) would be telling people to harden up and face reality.

Australia abolished Inheritance Tax in 1979.And they have 10 years to pay off the tax. Who else gets taxed at a lower rate and gets 10 years to pay it?

40k off a 3mil asset sounds like a bad investment that they are holding onto for sentimental reasons.

Any other situation and the tax-minimising toffs (Clarkson is a toff no matter what he claims) would be telling people to harden up and face reality.

One of the reasons that led to the abolishment of the estate tax in Australia was the criticism that the amount of revenue raised was insignificant compared to the administrative costs.

Starmer's 'reset' speech can't hide how badly he is doing

- Nov 10, 2022

- 15,367

- 12,900

- AFL Club

- Hawthorn

South West Rail, c2c and Greater Anglia rail companies to be nationalised in 2025

Similar threads

- Locked

- Poll

- Replies

- 5K

- Views

- 125K

- Replies

- 96

- Views

- 6K

- Replies

- 74

- Views

- 4K

- Replies

- 10K

- Views

- 287K

- Replies

- 10K

- Views

- 235K